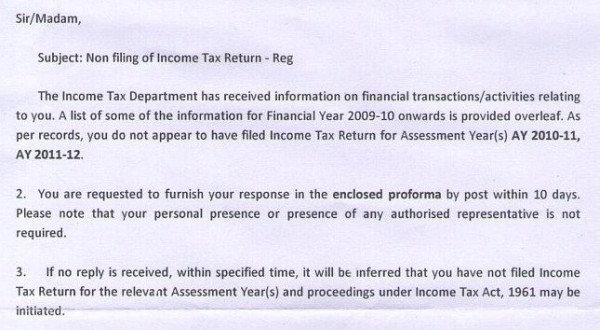

non filing of income tax return

Up to 3 cash back REPUBLIC OF THE PHILIPPINES VALENZUELA CITYSS. Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022.

At the applicable rate in force as prescribed in the Finance Act.

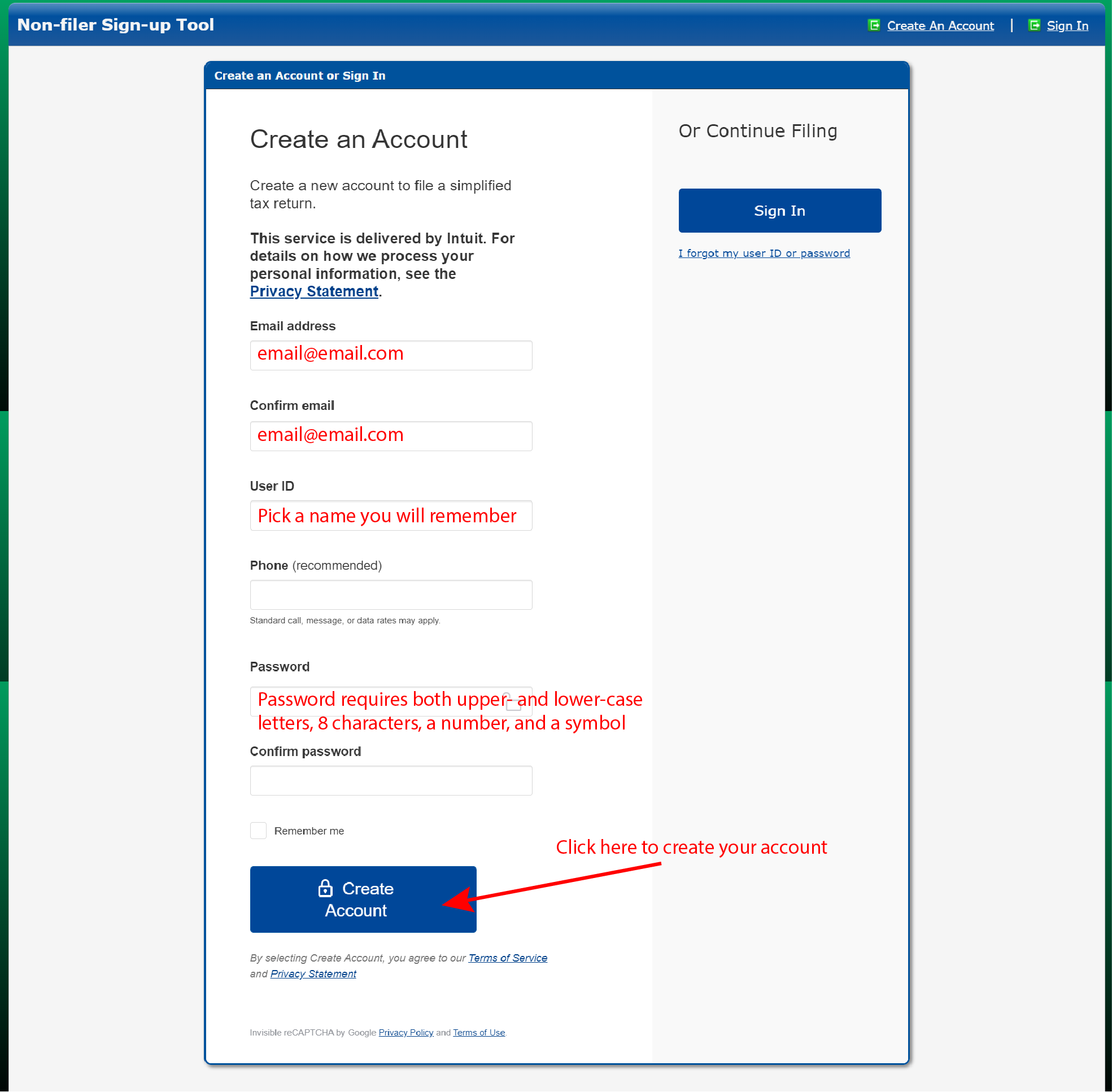

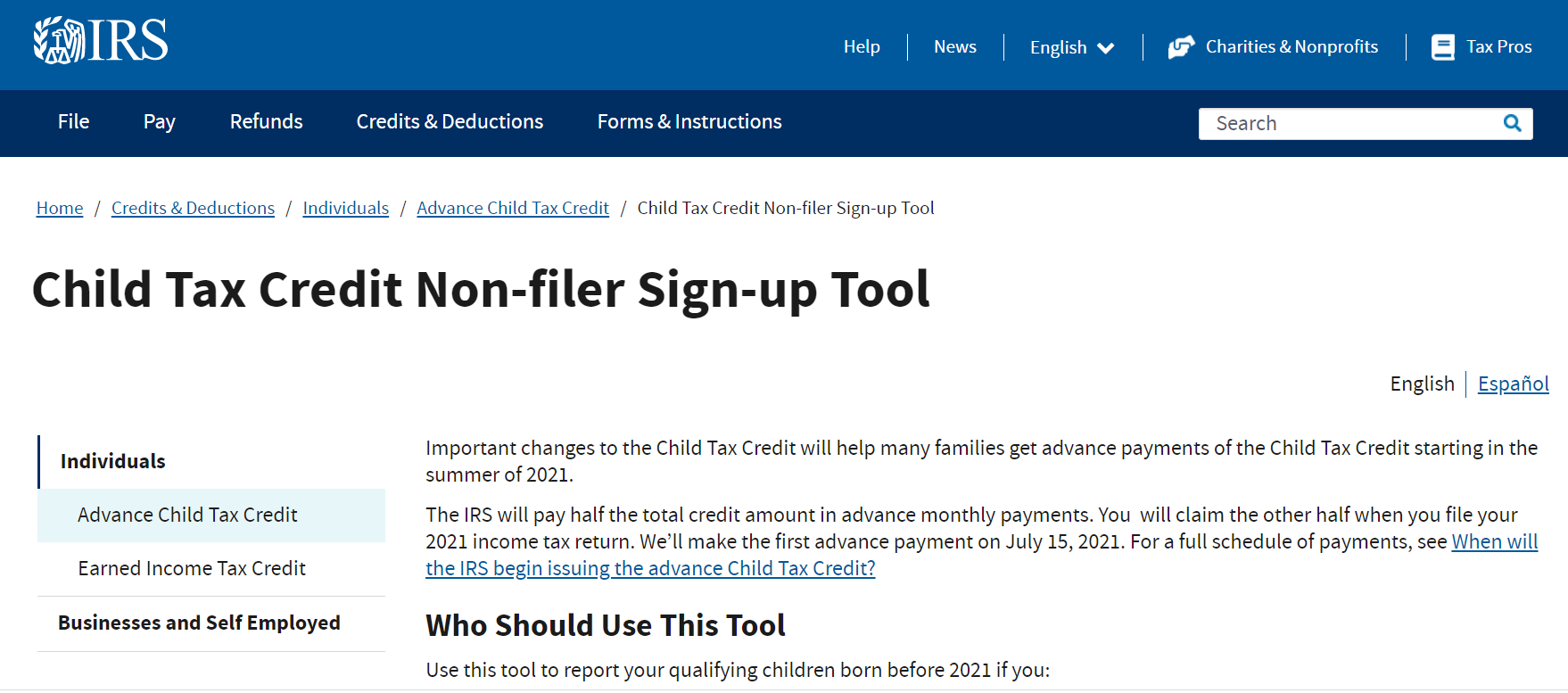

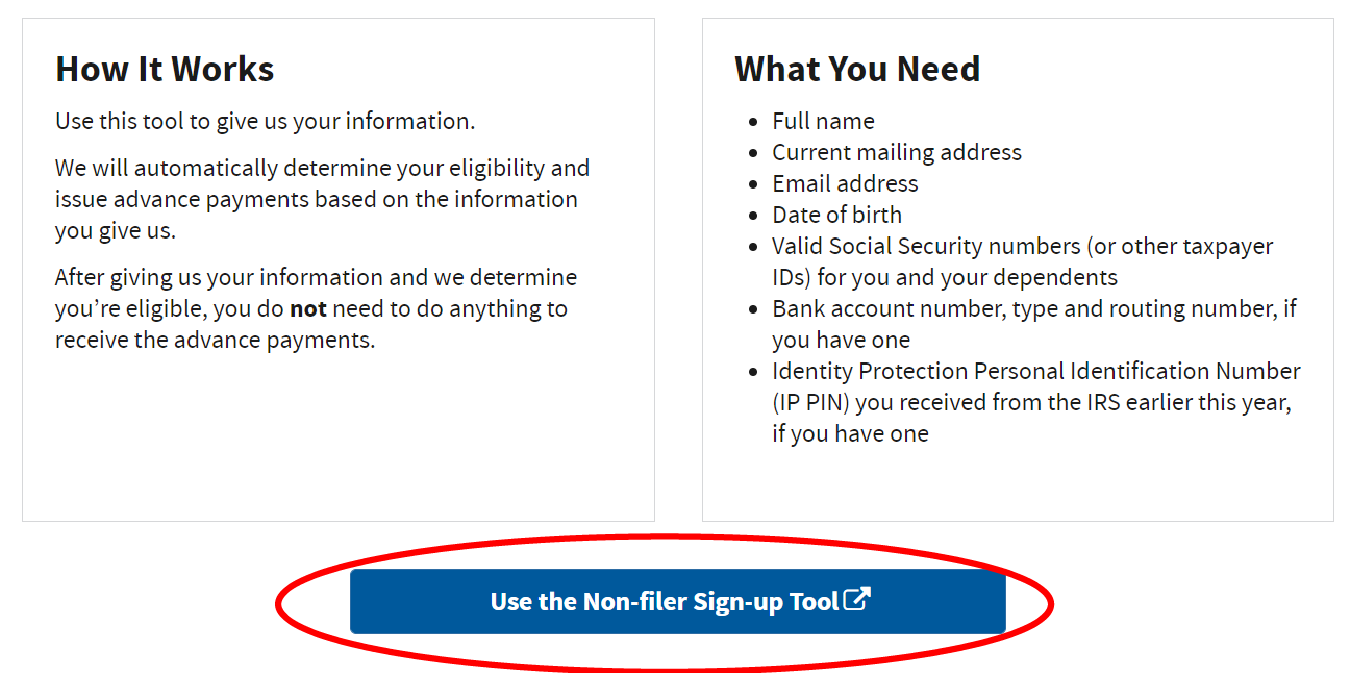

. File a simplified 2021 tax return through GetCTC before November 15 2022. Income Tax Return ITR filing is a must for salaried employees having an annual income above Rs 25 lakh. As a general rule taxpayers are required to use the same filing status for their Vermont income tax return as they do on their federal return.

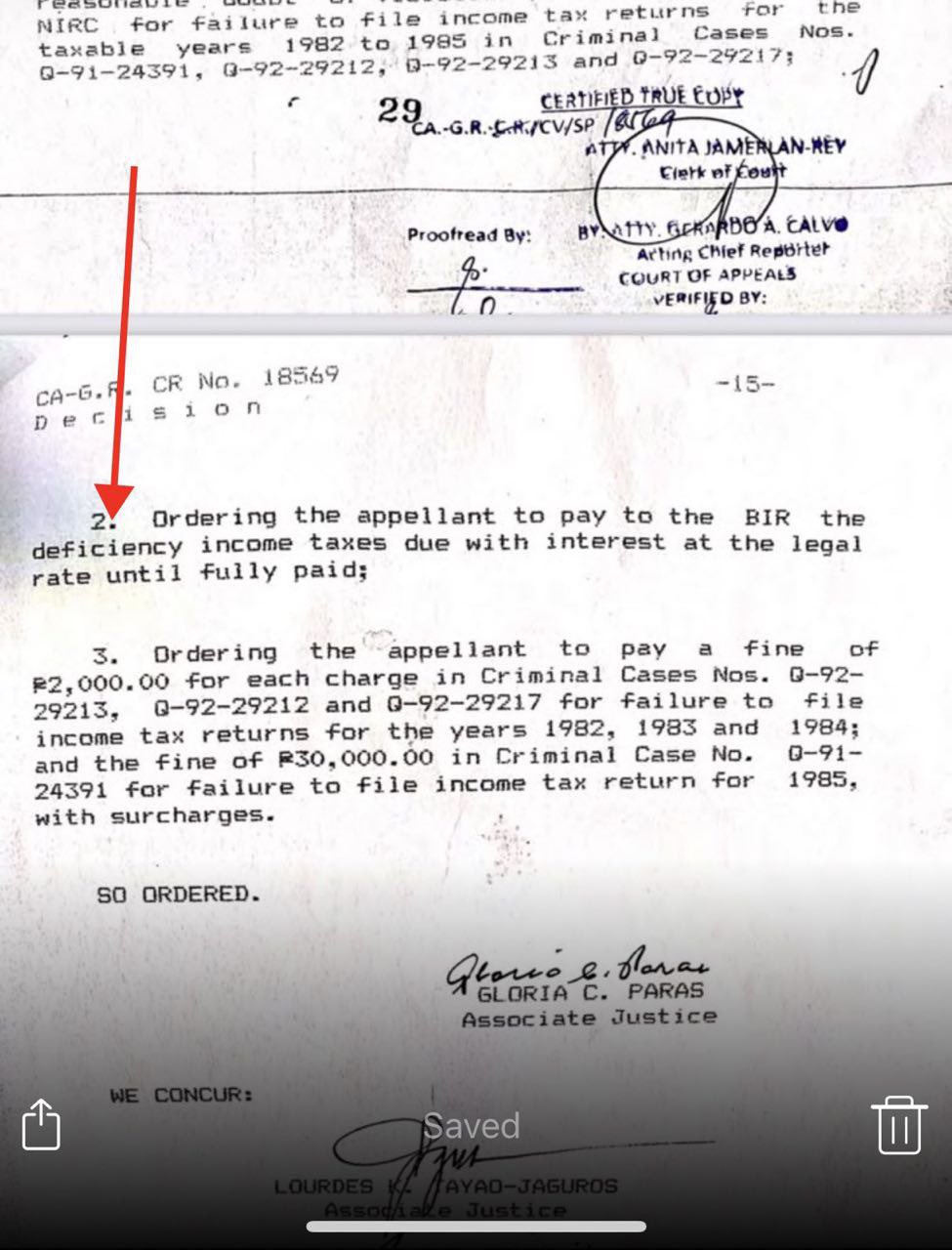

Thus committed offence under Section 276. 17 deadline but submit your state income tax return by. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the.

The Income Tax Appellate Tribunal ITAT Mumbai Bench has recently in an appeal filed before it while upholding the reassessment under section 147 of the Income Tax. You can file the current years return andor returns from two 2 prior years. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years.

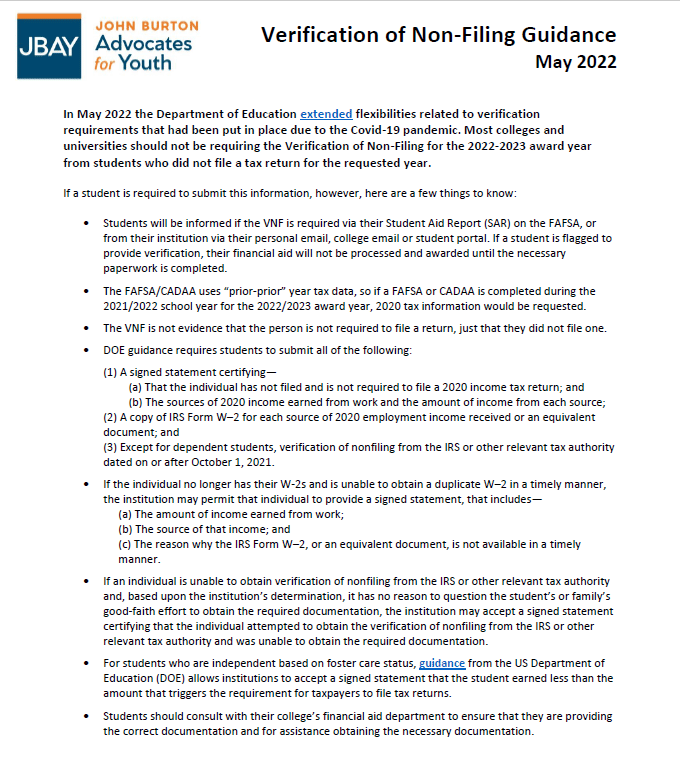

Income tax is paid by every individual who earns above INR 25 Lakhs per annum. Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways. The Supreme Court of India in a recent judgment Sasi Enterprises v Assistant Commissioner of Income Tax Criminal Appeal No 612007 categorically declared it is a.

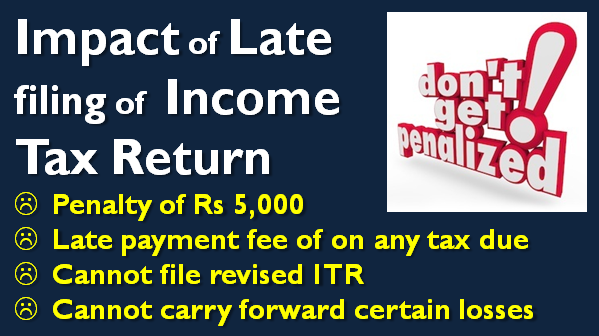

PENALTIES FOR LATE FILING OF TAX RETURNS. Non- filing of income tax return leads to heavy penalties with interest us 234 A 234 B and 234 C accordingly. If you missed the Oct.

As per section 276C if a person wilfully attempts to evade tax penalty or interest or under-reports his income then he shall be punished. AFFIDAVIT OF NON-FILING OF INCOME TAX RETURN We DANTE N. You will be able to file your returns whether you are expecting a refund have a balance due or no.

Petitioner concealed his true and correct income by not filing return of income not paying the advance tax and the demand tax. Nonresident Spouse with no Vermont Income. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due.

The failure-to-file penalty grows every month at a set rate. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less. If the tax due is more than 10000 then you must pay an.

The Income Tax rules have several provisions through. If you have not yet filed your 2021 return you are still eligible if you file by Sept. Order copies of tax records including transcripts of past tax returns tax account information wage and income statements and verification of non-filing letters.

Twice the rate stated in the relevant Income Tax Act provisions. Firstly with rigorous imprisonment which. For possible tax evasion exceeding Rs25 lakhs.

Similar to TDS if a person has non filed. Mailing in a form. Make an appointment at your local taxpayer assistance.

Post the limit of INR 25 Lakhs each and every individual is liable to pay taxes. The IRS said it urges people to file their tax form electronically and to choose direct deposit in.

How To Fill Out The Irs Non Filer Form Get It Back

Us Tax Return Filing For Us Citizen Or Non Resident Usa Expat Taxes

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Penalty For Late Filing Of Income Tax Return Ay 2022 23 Late Fees And Interest

Non Filling Of Income Tax Return Cib 321 Income Tax Notification

How To Fill Out The Irs Non Filer Form Get It Back

Congress Again Considers Free Irs Income Tax Filing System Cpa Practice Advisor

𝗔𝘁𝘁𝗲𝗻𝘁𝗶𝗼𝗻 𝗧𝗮𝘅𝗽𝗮𝘆𝗲𝗿𝘀 Avoid Late Income Tax Return Facebook

How To Fill Out The Irs Non Filer Form Get It Back

Verification Beyond The Basics Ppt Download

Not Filing Your Income Tax Returns On Time You Could Be Prosecuted Rahul Jain Nangia Andersen India Pvt Ltd

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Accurals Accounting Management Solutions Taxpayers Who Do Not File Their Income Tax Return On Time Can Be Subject To Penalty And Charged An Interest On The Late Payment Of Income

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Sample Letter For Non Filing Of Income Tax Return Fill Out Sign Online Dochub

Penalty For Late Filing Of Income Tax Return

How To File A Zero Income Tax Return 11 Steps With Pictures